First HoldCo Plc, the parent of Nigeria’s oldest lender, First Bank, is confident it will have scaled up core capital to at least N500 billion by July this year, eight months ahead of the cut-off time set for banks in Nigeria to raise the capital to new thresholds.

“Before the end of July, the bank will be at the minimum required capitalisation from the central bank,” Managing Director Wale Oyedeji said at an annual meeting of shareholders on Thursday.

The group already has 30 per cent of the cash in its kitty from a recent rights issue that sold N150 billion worth of common stock to shareholders and intends to raise the balance through private placement.

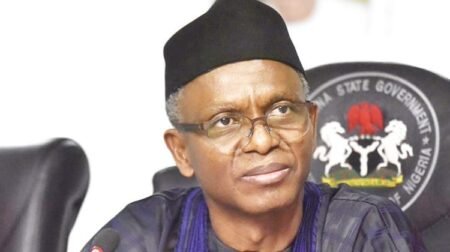

The proposed share sale to affluent investors will kick off in two weeks, Femi Otedola, chairman and top shareholder, told the meeting, adding that his combined investment in the holding company will have surpassed N300 billion by the time the planned offer is over.

To better position Nigerian lenders for the N1 trillion economy, it seeks to attain by 2030, the CBN is asking banks to create buffers and expand paid-in capital to significantly higher levels.

Lenders with international authorisation, the licence class to which First Bank and the rest of the country’s biggest lenders collectively called FUGAZ, have seen their minimum capital raised tenfold to N500 billion under the new rules.

Access Holdings, Nigeria’s largest lender by assets, and Zenith Bank are already home and dry, having met the conditions. GTCO, the country’s biggest lender by market value, which raised N209.4 billion from retail investors last year, is looking to raise more cash this year, especially from international investor,s to make up the deficit.

READ ALSO: Otedola praises Tinubu’s, Cardoso’s reforms as First HoldCo’s annual profit surges

United Bank for Africa, whose verified capital now stands at N355.2 billion, has also said it will raise the balance this year.

Credit ratings agency Fitch foresees that a couple of mergers and acquisitions among small-tier banks will likely result, owing to pressure to meet the new rules.

Read the full article here